godley is an R package for simulating stock-flow

consistent (SFC) macroeconomic models.

By employing godley, users can create fully fledged post-keynesian and MMT models of the economy to:

The package offers the flexibility to support both theoretical frameworks and data-driven scenarios.

It is named in honor of Wynne Godley (1926–2010), a prominent British post-Keynesian economist and a leading figure in SFC modeling.

godley is currently hosted on GitHub github.com/gamrot/godley. To

install the development version directly, please use

devtools package:

install.packages("devtools")

devtools::install_github("gamrot/godley")The following demonstrates a basic example of using the package to simulate a baseline scenario in the classic SIM model (Godley & Lavoie, Monetary Economics, 2007).

To define the model structure, start by creating an empty model with

the create_model() function.

The resulting model is an S3 object (a list) of the SFC class.

model_sim <- create_model(name = "SFC SIM")Use the add_variable() function to include variables in

the model. This function creates a $variables tibble within

the model.

⚠️ Remarks:

§, £, @, #,

$, {, }, ;,

:, ', \, ~,

`, ?, !, %,

^, &, *, (,

), -, +, =,

[, ], |, <,

,, >, /._) when naming variables.model_sim <- model_sim |>

add_variable("C_d", desc = "Consumption demand by households") |>

add_variable("C_s", desc = "Consumption supply") |>

add_variable("G_s", desc = "Government supply") |>

add_variable("H_h", desc = "Cash money held by households") |>

add_variable("H_s", desc = "Cash money supplied by the government") |>

add_variable("N_d", desc = "Demand for labor") |>

add_variable("N_s", desc = "Supply of labor") |>

add_variable("T_d", desc = "Taxes, demand") |>

add_variable("T_s", desc = "Taxes, supply") |>

add_variable("Y", desc = "Income = GDP") |>

add_variable("Yd", desc = "Disposable income of households") |>

add_variable("alpha1", init = 0.6, desc = "Propensity to consume out of income") |>

add_variable("alpha2", init = 0.4, desc = "Propensity to consume out of wealth") |>

add_variable("theta", init = 0.2, desc = "Tax rate") |>

add_variable("G_d", init = 20, desc = "Government demand") |>

add_variable("W", init = 1, desc = "Wage rate")

model_sim$variables

## # A tibble: 16 × 3

## name init desc

## <chr> <list> <chr>

## 1 C_d 0 Consumption demand by households

## 2 C_s 0 Consumption supply

## 3 G_s 0 Government supply

## 4 H_h 0 Cash money held by households

## 5 H_s 0 Cash money supplied by the government

## 6 N_d 0 Demand for labor

## 7 N_s 0 Supply of labor

## 8 T_d 0 Taxes, demand

## 9 T_s 0 Taxes, supply

## 10 Y 0 Income = GDP

## 11 Yd 0 Disposable income of households

## 12 alpha1 0.6 Propensity to consume out of income

## 13 alpha2 0.4 Propensity to consume out of wealth

## 14 theta 0.2 Tax rate

## 15 G_d 20 Government demand

## 16 W 1 Wage rateThen, specify the system of equations that governs the model. This

can be done using the add_equation() function by providing

the equations in text form. The model will then include a

$equations tibble.

Equations must adhere to the following rules:

§, £, @, #,

$, {, }, ;,

:, ', \, ~,

`.!, %, ^, &,

*, (, ), -,

+, =, [, ],

|, <, ,, >,

/.C_s for consumption. Constructs like C_s*2 or

log(C_s) are not allowed on the left-hand side. If an

operator or function appears on the left, the entire expression will be

treated as the variable name.= must separate the left-hand side from

the right-hand side.C_s[-1], and the third lag as C_s[-3]. The

package supports lags up to the fourth order, which is particularly

useful for quarterly data. This syntax mirrors the behavior of the

lag() function in R.C_s - C_s[-1], can be written as d(C_s). This

is equivalent to the diff() function in R. Note that this

operation is defined only for the first difference; higher-order

differences, such as the third difference, must be expressed explicitly,

e.g., C_s - C_s[-3].d(C_s[-1]).model_sim <- model_sim |>

add_equation("C_s = C_d", desc = "Consumption") |>

add_equation("G_s = G_d") |>

add_equation("T_s = T_d") |>

add_equation("N_s = N_d") |>

add_equation("Yd = W * N_s - T_s") |>

add_equation("T_d = theta * W * N_s") |>

add_equation("C_d = alpha1 * Yd + alpha2 * H_h[-1]") |>

add_equation("H_s = G_d - T_d + H_s[-1]") |>

add_equation("H_h = Yd - C_d + H_h[-1]") |>

add_equation("Y = C_s + G_s") |>

add_equation("N_d = Y/W") |>

add_equation("H_s = H_h", desc = "Money equilibrium", hidden = TRUE)

model_sim$equations

## # A tibble: 12 × 3

## equation hidden desc

## <chr> <lgl> <chr>

## 1 C_s = C_d FALSE "Consumption"

## 2 G_s = G_d FALSE ""

## 3 T_s = T_d FALSE ""

## 4 N_s = N_d FALSE ""

## 5 Yd = W * N_s - T_s FALSE ""

## 6 T_d = theta * W * N_s FALSE ""

## 7 C_d = alpha1 * Yd + alpha2 * H_h[-1] FALSE ""

## 8 H_s = G_d - T_d + H_s[-1] FALSE ""

## 9 H_h = Yd - C_d + H_h[-1] FALSE ""

## 10 Y = C_s + G_s FALSE ""

## 11 N_d = Y/W FALSE ""

## 12 H_s = H_h TRUE "Money equilibrium"With all variables and equations defined, the model is ready to be

solved over a given time horizon. This can be done using the

simulate_scenario() function. The function starts by

validating the user-defined model through the prepare()

function, which is also accessible in the package’s exported

environment.

The function allows choosing a simulation method (Newton

or Gauss), selecting the number of periods and a starting

date. Specifying an initial period is optional; if omitted, periods will

simply be numbered consecutively with natural numbers.

By default, equations are solved using the Gauss method. Independent

equations for a specific period are resolved in a single iteration.

Interdependent equations are grouped into loops and solved iteratively.

For the first period, the method uses the provided initial values

(init). In subsequent iterations, it relies on the results

of the previous iteration for all variables. The process continues until

the solution converges within the specified tolerance (tol)

or the maximum number of iterations (max_iter) is reached.

If any period produces a value of Inf, NaN, or

NA, the process is stopped, and an error message is

displayed.

Before solving equations, their order is determined to:

The Newton method works similarly but uses the Newton-Raphson

algorithm to solve interdependent equations. This algorithm is

implemented via the rootSolve::multiroot() function.

During the model-building phase, setting the info = TRUE

argument can be helpful. This returns the result of the

prepare() function, providing details on the classification

of all variables (endogenous/exogenous) and other summary information

about the input data.

Simulation results are saved in a $result tibble linked

to the scenario being simulated (e.g., the baseline scenario is stored

as $baseline).

model_sim <- model_sim |>

simulate_scenario(

periods = 100, start_date = "2015-01-01",

method = "Gauss", max_iter = 350, tol = 1e-05

)

model_sim$baseline$result

## # A tibble: 100 × 17

## time C_s G_s T_s N_s Yd T_d C_d H_s H_h Y N_d

## <date> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 2015-01-01 0 0 0 0 0 0 0 0 0 0 0

## 2 2015-04-01 18.5 20 7.69 38.5 30.8 7.69 18.5 12.3 12.3 38.5 38.5

## 3 2015-07-01 27.9 20 9.59 47.9 38.3 9.59 27.9 22.7 22.7 47.9 47.9

## 4 2015-10-01 35.9 20 11.2 55.9 44.8 11.2 35.9 31.5 31.5 55.9 55.9

## 5 2016-01-01 42.7 20 12.5 62.7 50.2 12.5 42.7 39.0 39.0 62.7 62.7

## 6 2016-04-01 48.5 20 13.7 68.5 54.8 13.7 48.5 45.3 45.3 68.5 68.5

## 7 2016-07-01 53.3 20 14.7 73.3 58.6 14.7 53.3 50.6 50.6 73.3 73.3

## 8 2016-10-01 57.4 20 15.5 77.4 61.9 15.5 57.4 55.2 55.2 77.4 77.4

## 9 2017-01-01 60.9 20 16.2 80.9 64.7 16.2 60.9 59.0 59.0 80.9 80.9

## 10 2017-04-01 63.8 20 16.8 83.8 67.1 16.8 63.8 62.2 62.2 83.8 83.8

## # … with 90 more rows, and 5 more variables: alpha1 <dbl>, alpha2 <dbl>,

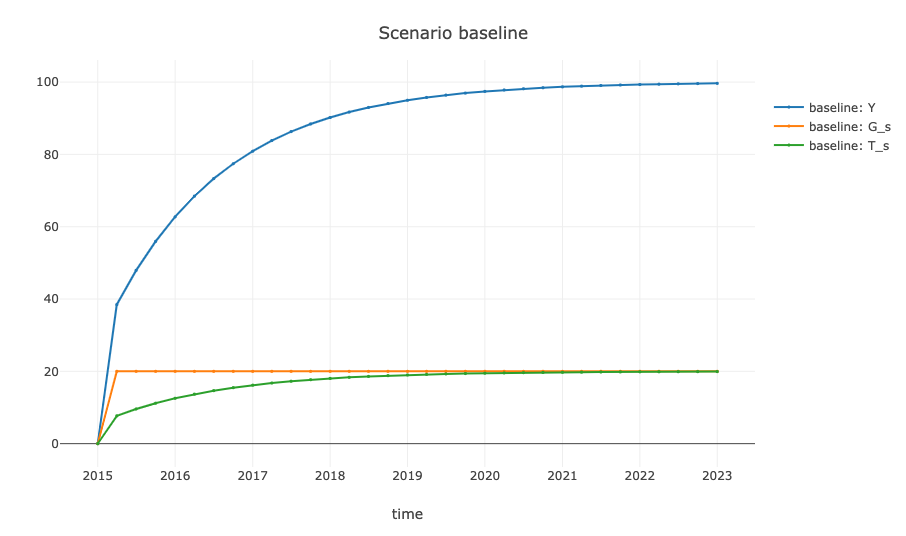

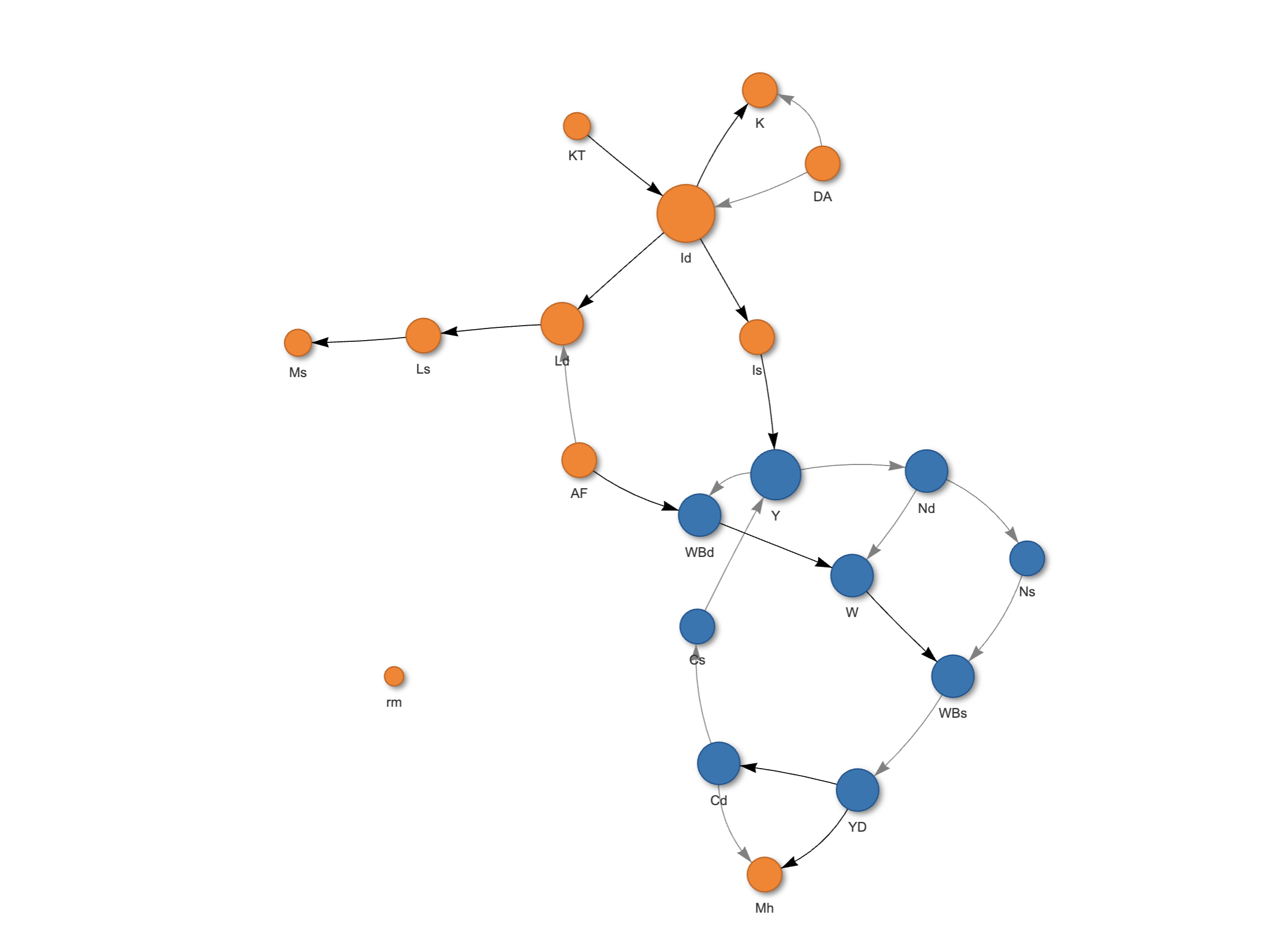

## # theta <dbl>, G_d <dbl>, W <dbl>The godley package provides customized visualization capabilities to enhance the analysis of simulation outcomes.

Users can leverage the plot_simulation() function to

create plots, by specifying the time range with from and

to, along with a list of expressions. These

expressions can include variable names or calculations derived from

them, such as G_s/Y. In the example below, the plot

displays the expressions for Income, Government Spending, and Taxes.

plot_simulation(

model_sim, scenario = "baseline",

from = "2015-01-01", to = "2023-01-01",

expressions = c("Y", "G_s", "T_s")

)

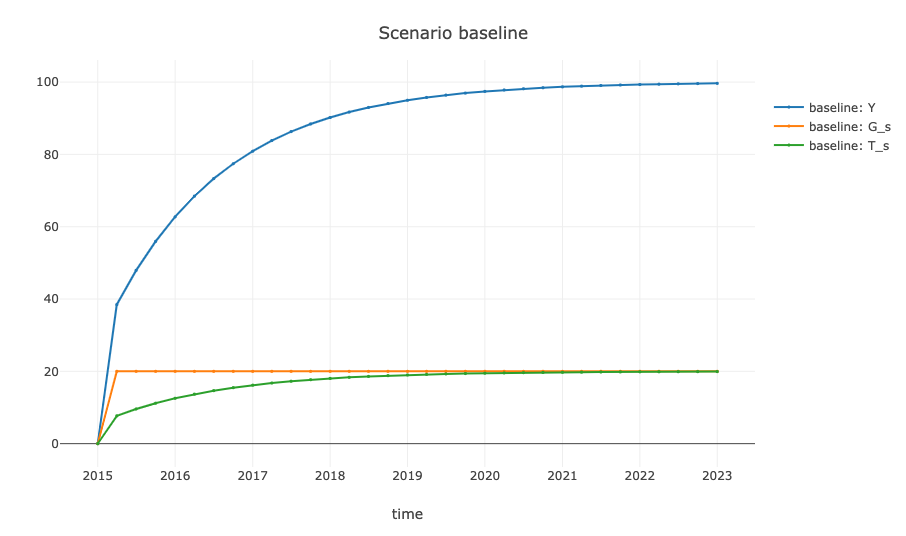

Beyond plotting variables over time, the plot_cycles()

function provides a way to visualize the model’s structure and uncover

loops (feedback mechanisms and endogeneity) within the interdependencies

between variables, offering an intuitive approach for interpreting and

communicating the results of macroeconomic simulations.

plot_cycles(model_sim)

To streamline model creation, godley comes with

predefined templates. Rather than starting with an empty model and

manually adding equations each time, users can reuse a previously

created model or choose from the classic SFC models (Godley &

Lavoie, 2007) included in the package. These templates are available

through the template argument in the

create_model() function. The available templates include

SIM, SIMEX, PC,

PCEX, LP, REG, OPEN,

BMW, BMWK, DIS, and

DISINF, covering all models presented in Godley &

Lavoie (2007).

The package allows users to introduce and simulate shocks within the model.

An alternative shock scenario is defined by:

To create a shock, begin by initializing an empty S3 object (list) of

the SFC_shock class using the create_shock()

function. Next, add the shock parameters for selected variables

(variable) using the add_shock() function.

Shock values can be defined explicitly (value), as a

relative rate (rate), or as an absolute increment

(absolute).

For example, a 20% increase in government spending can be simulated

by first creating a shock object using create_shock() and

then applying it with add_shock() for the period between Q1

2017 and Q4 2020.

sim_shock <- create_shock() |>

add_shock(

variable = "G_d", rate = 0.2,

start = "2017-01-01", end = "2020-10-01",

desc = "permanent increase in government expenditures"

)Once the shock has been defined, it can be incorporated into a new

scenario using add_scenario(). The baseline scenario and

corresponding time periods must first be specified. After establishing

the shock scenario, the simulate_scenario() function can be

executed again to generate the updated results.

model_sim <- model_sim |>

add_scenario(

name = "expansion", origin = "baseline",

origin_start = "2015-01-01", origin_end = "2023-10-01",

shock = sim_shock

) |>

simulate_scenario(periods = 100)

model_sim$expansion$result

## # A tibble: 100 × 17

## time C_s G_s T_s N_s Yd T_d C_d H_s H_h Y N_d

## <date> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 2015-01-01 0 0 0 0 0 0 0 0 0 0 0

## 2 2015-04-01 18.5 20 7.69 38.5 30.8 7.69 18.5 12.3 12.3 38.5 38.5

## 3 2015-07-01 27.9 20 9.59 47.9 38.3 9.59 27.9 22.7 22.7 47.9 47.9

## 4 2015-10-01 35.9 20 11.2 55.9 44.8 11.2 35.9 31.5 31.5 55.9 55.9

## 5 2016-01-01 42.7 20 12.5 62.7 50.2 12.5 42.7 39.0 39.0 62.7 62.7

## 6 2016-04-01 48.5 20 13.7 68.5 54.8 13.7 48.5 45.3 45.3 68.5 68.5

## 7 2016-07-01 53.3 20 14.7 73.3 58.6 14.7 53.3 50.6 50.6 73.3 73.3

## 8 2016-10-01 57.4 20 15.5 77.4 61.9 15.5 57.4 55.2 55.2 77.4 77.4

## 9 2017-01-01 64.6 24 17.7 88.6 70.9 17.7 64.6 61.4 61.4 88.6 88.6

## 10 2017-04-01 69.4 24 18.7 93.4 74.7 18.7 69.4 66.8 66.8 93.4 93.4

## # … with 90 more rows, and 5 more variables: alpha1 <dbl>, alpha2 <dbl>,

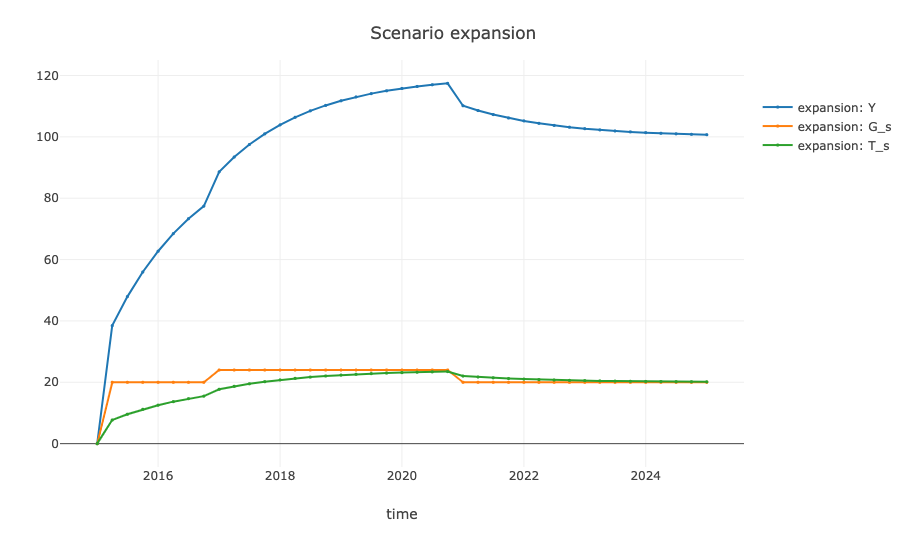

## # theta <dbl>, G_d <dbl>, W <dbl>The results indicate that increased government expenditures have a positive effect on income, but a less favorable short-term impact on the government balance. This outcome can be visualized as follows:

plot_simulation(

model_sim, scenario = "expansion",

to = "2025-01-01", expressions = c("Y", "G_s", "T_s")

)

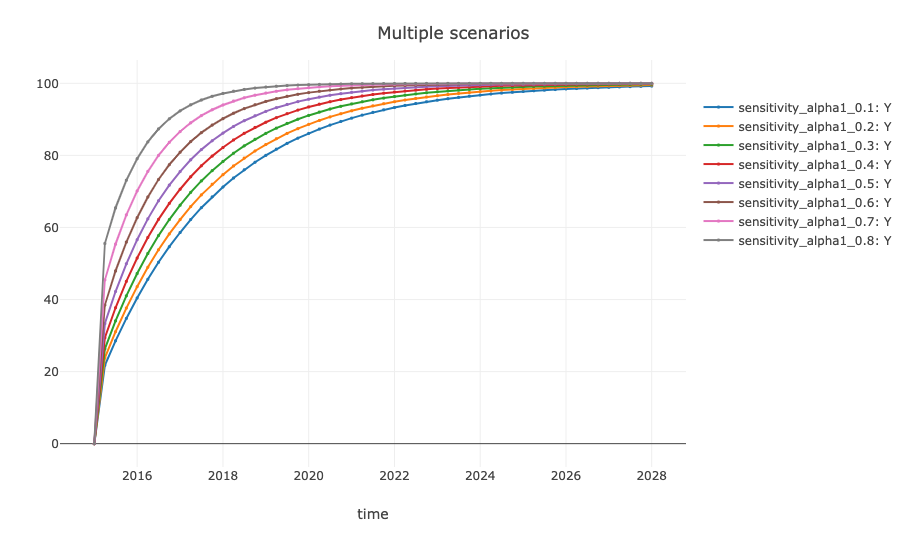

The godley package allows for the assessment of

simulation result sensitivity to specific parameter values. For example,

the effect of small adjustments to alpha1 on short-term

dynamics can be analyzed by first creating a new model object with

create_sensitivity() and specifying the upper and lower

bounds for the parameter of interest.

The create_sensitivity() function generates a new SFC

object based on an existing model and automatically adds multiple

scenarios. These scenarios differ only in the value of the selected

parameter (variable), which is varied across a specified

range defined by lower, upper, and

step.

Once the sensitivity scenarios are generated, the simulations can be executed:

model_sens <- model_sim |>

create_sensitivity(

variable = "alpha1", lower = 0.1, upper = 0.8, step = 0.1

) |>

simulate_scenario(periods = 100, start_date = "2015-01-01")The results can be displayed in a plot. To visualize multiple

scenarios that share the same scenario substring in their

names, set the take_all = TRUE argument.

plot_simulation(

model_sens, scenario = "sensitivity", take_all = TRUE,

to = "2028-01-01", expressions = c("Y")

)

More examples and detailed information about godley functions and model setups are available at the package website.

create_model(): Create an SFC model.add_variable(): Add variables to the model.add_equation(): Add equations to the model.simulate_scenario(): Simulate one or more

scenarios.plot_simulation(): Plot simulation results.plot_cycles(): Visualize model structure and feedback

loops.create_shock(): Create a shock object.add_shock(): Add shock parameters.add_scenario(): Add a new scenario to an existing

model.create_sensitivity(): Generate sensitivity scenarios

for selected parameters.The following packages also provide approaches to stock-flow consistent modeling:

If any issues arise or bugs are encountered, please file a report with a minimal reproducible example at https://github.com/gamrot/godley/issues.